This Week in the Economy: White House Actions Are Boosting the Economy

There was a lot of good news this past week to justify optimism about the economy. It's a bumpy road to peace and prosperity, but unlike his predecessor, Trump is trying.

Guest post by economist Robert Genetski, Ph.D.

Unlock exclusive financial insights and expert analysis to navigate market trends and make informed investment decisions: subscribe@classicalprinciples.com.

External events are giving a boost to the economy. President Trump’s bombing and destruction of Iran’s nuclear facilities has raised his stature with most voters, strengthening his hand with Republicans. Although Senate Republicans have struggled to put together their version of the One Big Beautiful Bill (OBBB), they will likely succeed in handing Trump still another victory.

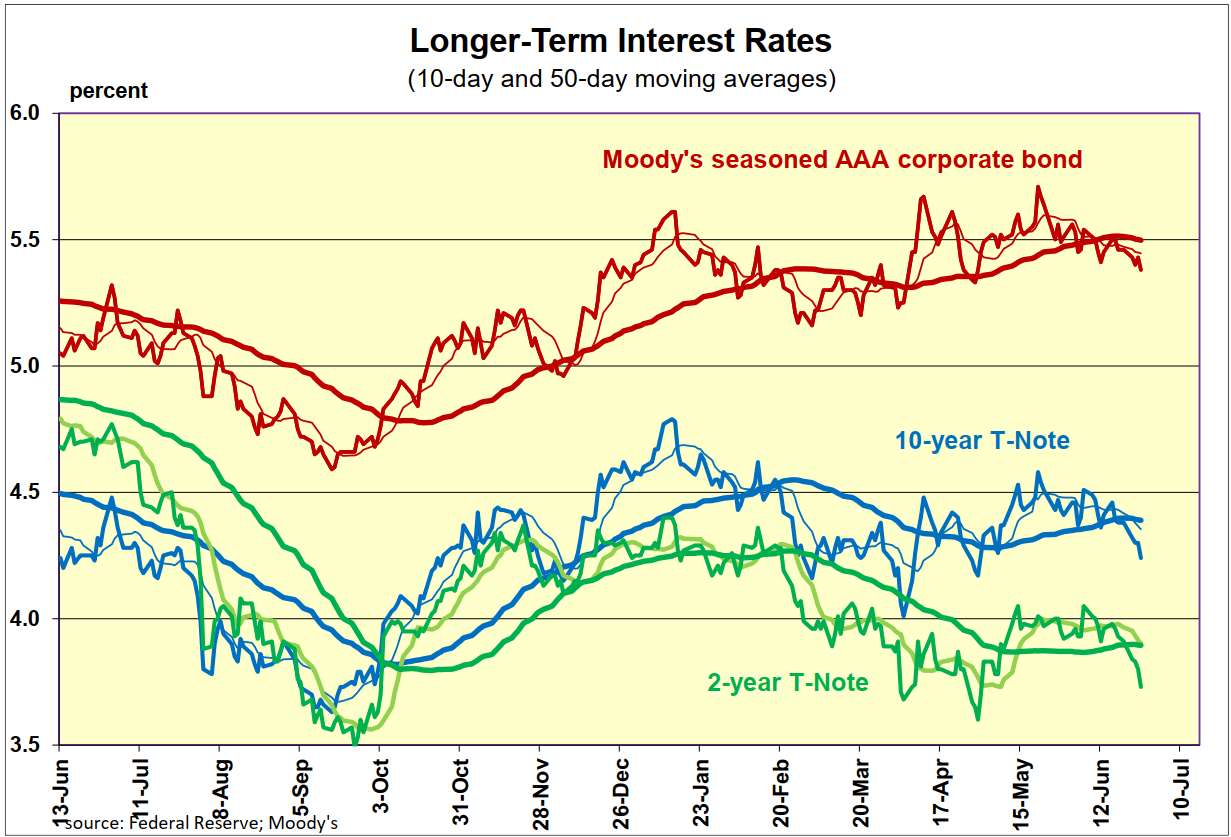

In another piece of good news, Trump announced he has signed a trade agreement with China. Amid a steady rise in optimism about the future, long-term interest rates have moved further below their 50-day moving averages. This is often a sign of additional downward pressure on rates.

Friday’s report on May consumer spending, incomes, and inflation confirmed that the economy continued to grow in the second quarter while inflation remains under control. Year-over-year inflation is in the vicinity of 2½ percent. The latest monthly

inflation was 0.1 percent for the total and 0.2 percent for core inflation.

Earlier in the week, S&P’s business survey for early June showed the economy still increasing, with service companies registering a 53 and manufacturing a 52 (50 represents no growth).

This week’s news begins tomorrow with the business surveys for manufacturing and on Wednesday for service companies. The May surveys from ISM (Institute for Supply Management) showed slightly negative readings for both manufacturing and service companies. In contrast, S&P showed the economy was growing.

As noted above, S&P’s survey for early June continues to show both manufacturing and service companies growing with readings of 52 and 53, respectively. Look for both surveys to show the economy growing in June.

Also on Wednesday, ADP will report its June payroll job data. ADP job growth was only 37,000 in May. Job data from the Labor Department show a gain of 140,000 private payroll jobs but a decline of 623,000 full-time jobs. We are hoping Wednesday’s ADP data and Thursday’s Labor Department job report will produce some sense of reconciliation for the extreme differences in the employment picture.

Also Thursday, look for some clarity on the erratic moves in total new orders and shipments by manufacturers.