The Worst Interest Rate of Them All

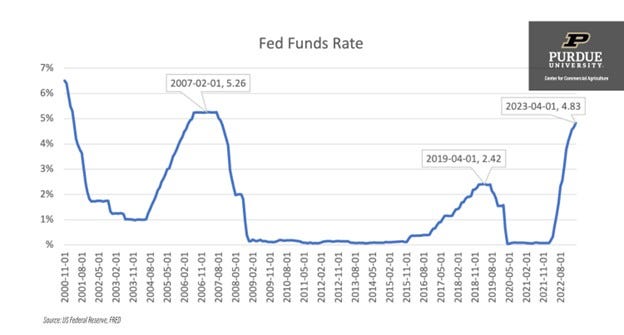

President Donald Trump’s disputes with the Federal Reserve have centered on the central bank’s refusal to reduce interest rates by cutting the federal funds rate from its current target of 5.25 to 5.5 percent. That rate is much higher than it has been through most of this century:

I think that interest rates are too high and should be cut by a couple of percentage points. That would stimulate economic growth (or rather, stop suppressing growth), and it would not increase inflation if done at a measured pace.

However, the fed funds rate might not be the best means of decreasing interest rates at present, Unleash Prosperity’s Hotline suggests:

With a rate cut likely in September, now the issue is: WHICH interest rate should the Fed cut?

Lowering the Federal Funds Rate isn’t going to achieve much, because few banks borrow at that rate today.

The fed funds rate is “the interest rate at which depository institutions trade federal funds (balances held at Federal Reserve Banks) with each other overnight,” the St. Louis Fed states. The Fed has a couple of other tools by which it manipulates the money supply and interest rates. One that I have mentioned several times in the past is the Fed’s purchases and sales of securities, which loosen or tighten the money supply and thereby lower or raise interest rates, respectively.

Another Fed tool is the interest it pays banks for the reserve balances they keep at the Fed, which Congress established in 2006 (right before the United States suffered a horrible liquidity crisis; just saying) and has expanded massively since. Those interest payments keep money out of circulation, so lowering them increases liquidity. “The interest rate is set by the Board of Governors, and it is an important tool of monetary policy,” the St. Louis Fed notes.

The Fed is paying banks a lot of money to keep dollars out of circulation:

That is the interest rate the Fed should reduce, Hotline argues, following a suggestion from Sen. Ted Cruz (R-TX):

We’re persuaded that Senator Ted Cruz of Texas is right that the Fed should cut the “IOR”, which is the 4.4% interest rate the Fed pays to banks on their reserve balances held at the Fed. The IOR rate has more than doubled from [its] pre-2008 levels.

That money is doing nothing but enriching banks in the safest way possible (for the banks, that is), when it could be used to finance economic growth. The interest payments on reserves (IOR) push up interest rates, including interest costs on federal debt, causing a dead loss to the taxpayers:

These are funds that banks do NOT lend out to businesses, consumers, and homebuyers. As monetary expert Judy Shelton has asked: Why bother with private sector borrowers or even investing in traditional Treasury securities that require at least a 10-year commitment, when the returns don’t come close to what the banks are passively getting on overnight cash. Good question!

Today, nearly $3.5 trillion is being stored in reserves at the Fed by banks. High-powered money from bank deposits has become passive money.

The Fed gave banks $186 billion last year alone to store their money at the central bank—with foreign banks getting one-third of that.

“Gradually lowering the IOR rate would stimulate the economy by incentivizing more bank lending and may save the government money by not paying banks to do nothing,” the Hotline states.

The Foundation for Government Accountability argues that Congress should repeal the IOR authority altogether:

Paying interest on bank reserves was a bad idea from the start. It distorts economic decisions, injects further artificial complications into the financial system, increases interest rates, and hikes the federal deficit by pushing up interest payments on the national debt. Get rid of it quickly or slowly, but by all means get rid of it as soon as possible.