The Harris Inflation Tax

VP Harris's tie-breaking votes on two budget-busting, money-wasting, corruption-bankrolling spending bills are entirely responsible for the price inflation that is still causing so much suffering.

With the Core Personal Consumption Index having stabilized at a 2.6 percent annual inflation rate, the Federal Reserve (Fed) is poised to declare victory and start lowering interest rates to loosen the money supply and ensure that there is no recession before Kamala Harris can be elected president on November 5. (Fed Chair Jerome Powell has not said whether the central bank will pull back on its sales of securities, which tighten the money supply.)

Whether the money loosening has arrived in time to prevent a recession hitting after the election remains an open question. In any case, although the steadying of inflation at more than a half a percentage point above the Fed’s stated goal of 2 percent is somewhat-good news, the political effect of the monetary tightening of 2022 and 2023 may not be as great as desired regardless of whether a September rate cut averts or delays a recession.

As Harriet Torry and Terell Wright note at The Wall Street Journal, the rapid increase in inflation during the Biden-Harris administration raised prices more on important things than on nonessentials, and those prices are not coming down:

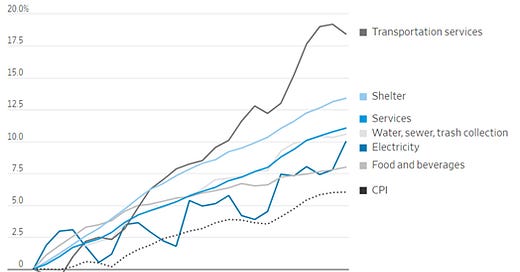

[P]rices for many of the things that are hard to do without are still posting eye-watering increases. Rent and electricity bills are up 10% or more over the past two years, and car-insurance costs are up nearly 40%, according to the Labor Department’s index. Shoppers might be able to trade down from prime steak to cheaper cuts of meat at the supermarket, but they can’t really do the same thing with the water bill.

Even after cutting back on nonessentials, people are finding it hard to maintain the quality of life they had before Biden and Harris occupied the White House, Torry and Wright observe:

Other types of spending are harder to avoid, and many of those items take up a large slice of households’ budgets. Overall consumer prices have increased 6% since June 2022, when inflation hit its recent high. Services—which include such things as dental cleanings, haircuts and eldercare—have risen nearly twice as fast. That is partly because dentists, salons and nursing homes have had to increase wages for their own workers, who are also dealing with rising prices.

People with children are being hit particularly hard: “The median price to put an infant in center-based care in 2022 was more than $1,400 a month in major metro areas, according to the Labor Department. A 6.4% increase puts that bill closer to $1,500,” the WSJ reporters write.

Personal automobile transportation, which of course is essential nearly everywhere despite the absurd dreams of public-transit promoters, is becoming unaffordable as car prices and the cost of insurance have skyrocketed:

The cost of transportation services, which includes vehicle insurance and repair, has jumped more than 18% in the past two years, according to the CPI. That would slap an extra $55 a month on a $300 budget. An increasing number of cash-strapped Americans are choosing to drive without car insurance.

All this inflation was caused by massive federal government overspending, financed by new debt, especially after the pandemic lockdowns largely ended in late 2020 and the economy recovered into 2021. The higher prices that people are suffering through today are entirely the fault of the Democrat-controlled (or -throttled) Congress of 2021-2022, President Joe Biden, and Vice President Kamala Harris, especially as the latter’s votes broke Senate ties on the two biggest budget-busting, money-wasting, corruption-bankrolling bills.

Torry and Wright quote an Atlanta-area single mom’s lament, “‘I have middle-class pay,’ said Moore, 32. ‘But I feel like I’m lower income.’”

Moore is lower-income indeed, like tens of millions of other Americans, because of Kamala Harris.