Tax Rates Matter

It is silly to talk about raising taxes as if it were a simple matter of will on the part of the government. There is a world of difference between raising tax rates and boosting tax revenues.

In 2016, the corporate tax rate in the United States was the highest in the world, at an average of 40 percent (including state and local taxes), “while the rest of the world was closer to 20%, and some countries were at or below 15%,” the Committee to Unleash Prosperity notes.

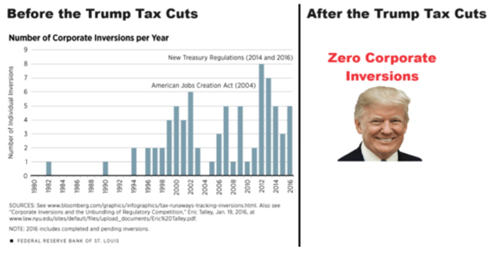

Those high tax rates were causing U.S. companies to move overseas to enjoy lower taxes abroad, a process known as corporate inversion. Those corporate relocations moved U.S. factories and jobs overseas.

Cutting the tax rate from 35 percent to 21 percent would encourage companies to remain in the United States, supply-side economic theory suggested. That policy was incorporated in the Tax Cuts and Jobs Act of 2017.

It worked. Perfectly.

In the five years from 2018 through 2022, not a single U.S. corporation underwent inversion, the Committee’s newsletter reports former House Ways and Means Committee Chairman Kevin Brady as stating.

“The companies and the jobs stayed here. They’re likely to stay firmly planted here—unless Biden or Kamala is elected and raises the rate back up to 28%,” the newsletter reports.

That is what winning looks like.

The reversal of the corporate inversion trend is as direct a confirmation of an economic principle as you are ever likely to see. Tax rates matter.

Major provisions of the Tax Cuts and Jobs Act expire at the end of this year. Highly beneficial effects of that tax reform bill will go by the wayside unless both Congress and the next president approve an extension.

Tax rates matter. Votes matter.