Raising Keynes

The Wall Street Journal regularly heralds discredited ideas by the father of the big excuse for ever-higher government spending.

In reviewing the current federal budget negotiations, I ran across the following sentence in a Wall Street Journal news story on the federal debt: “Policy hawks often promote austerity as a remedy, but reductions in government spending can hit jobs and slow growth.”

That sentence and the discussion that followed seemed to me to be pure Keynesianism—specifically, the premise that government spending can expand the economy by raising aggregate demand. If anything in this great cosmos has been disproven conclusively, it is Keynesian economics.

The story goes on to elaborate on the presumed danger of federal budget cuts:

Even in the event tighter fiscal policy is enacted, if it helped usher in a recession, automatic stabilizers would kick in and tax revenues would fall. The upshot: a bigger deficit.

“When you have substantial reduction in deficit spending—whether by raising taxes substantially or cutting spending—there’s an excellent chance you help precipitate a recession,” said [Hartford Funds fixed-income strategist Amar] Reganti. “It becomes a vicious cycle.”

Source: The Wall Street Journal

Here we have The Wall Street Journal arguing that reducing the federal budget deficit is a bad thing.

If anything in this great cosmos has been disproven conclusively, it is Keynesian economics.

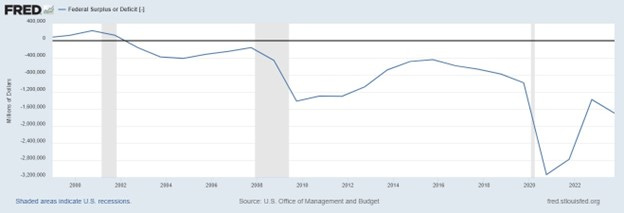

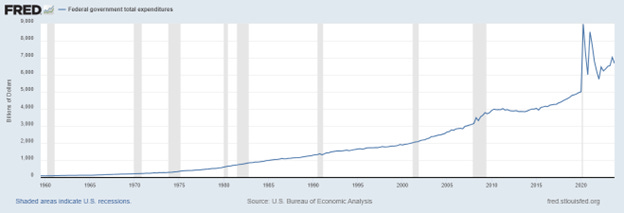

Here’s what the federal budget versus revenues looks like since the beginning of the previous century:

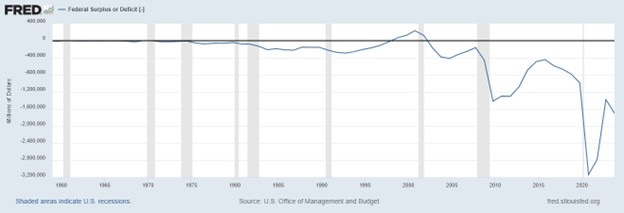

[Source for these four graphs: St. Louis Fed]

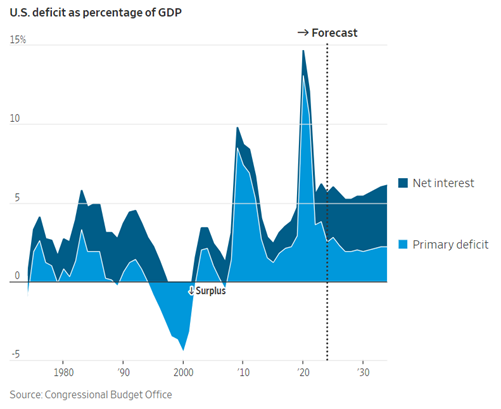

To home in on the relevant current situation, here’s what the past quarter-century looks like:

These deficits are all, always, caused by excessive federal spending (not tax rate reductions), as is evident by comparing the following graph with the above graphs for the same time period:

Here is what the 21st century deficits look like in the context of recent decades:

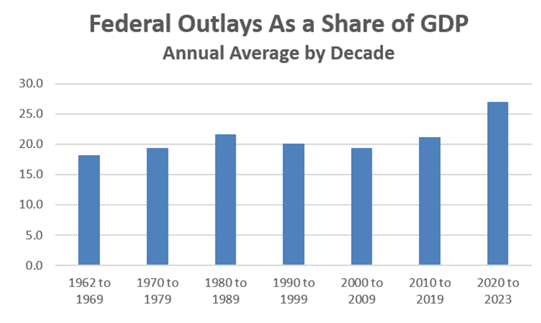

This graph from the Committee to Unleash Prosperity illustrates the ever-greater share of the U.S. economy the national government has gobbled up in the 2000s:

The implication that a 1 percent reduction in that regime of disastrous fiscal incontinence would risk tanking the economy is at best preposterous.

Thinking I must be missing some genius-level subtlety here, I asked some economist friends for their opinions.

Economic historian Brian Domitrovic of the Laffer Center said, “When government spending falls, [as in] the 1990s, the economy does great. Government spending gobbles up capital and labor that if left alone and facing low tax rates will bring growth.”

Economist and Heartland Daily News columnist Robert Genetski said, “Yes, it’s simple Keynesianism. My book Rich Nation/Poor Nation goes through the history of the United States since 1900. The case is clear: we should never look at the deficit to tell us anything about stimulus or restraint. We should look at spending and tax burdens as having a very different impact on the economy.

The implication that a 1 percent reduction in that regime of disastrous fiscal incontinence would risk tanking the economy is at best preposterous.

“On balance, federal spending growing faster than the rest of the economy weakens the economy and is characteristic of each period of progressive policies since the Wilson years in 1913,” Genetski said. “Increases in tax burdens are another characteristic of progressive economic policies. This combination explains every period of economic malaise or outright depression the United States has ever experienced. Our economic progress stopped whenever we adopted such policies. The opposite combination—federal spending growing slower than spending in the rest of the economy and lower tax burdens—created the booming economies of the 1920s, 1950s, and the Reagan years.”

Political scientist and economist Donald Devine, who served as director of the U.S. Office of Personnel Management under President Ronald Reagan, said, “I read that article at the time, and it is so wrong it is difficult to respond to.”

Devine waded in anyway: “The author backs into the truth by writing that cutting current spending to any politically possible level would not have much effect. Rather than [Treasury bonds] being ‘auctioned’ as the author suggests, there is an iceberg kept at the Fed from past spending, mostly unreported in interior ‘bonds.’ Compared to this, current cuts would be minor. And the author’s so-called ‘automatic stabilizers’ simply do not exist. His resulting ‘vicious cycle’ is much more the result of what is hidden in the Fed books than current spending, although of course more spending makes it worse. I don’t see how recession can be avoided.”

As these economists all note, we had best leave Keynes’ theories a-moldering in their grave.

All those "stimulus checks," I recall, went to pay down personal debt.