Puzzled by the Current Economy? You’re Not Alone

Are people really that worried about tariffs, or is there something far more important and consequential going on?

Once again, the economy has been sending mixed and confusing signals, confounding investors and policymakers alike. The most recent employment reports indicated the economy is not falling into a recession yet, despite the Atlanta Fed’s recent prediction of a major decline in GDP for the first quarter of the year.

In the face of that dire warning, the economy is still “mostly chugging along,” CNN reported:

Last week, the Federal Reserve Bank of Atlanta’s real-time GDP forecast projected the economy could contract by 2.8%. The negative swing doesn’t necessarily signal a recession: It largely reflects a sharper-than-expected pullback in post-holiday consumer spending and a larger inflow of imported goods in advance of tariffs.

The recession prediction was a big story, but it is difficult to believe it’s true—unless you really want to believe it. Just a couple of days later, the employment reports from the Bureau of Labor Statistics indicated otherwise. Conditions are essentially normal in the job market, The Wall Street Journal reported:

The U.S. continued to generate jobs at a steady pace in February, offering reassurances that the labor market has remained relatively stable since President Trump took office.

The U.S. added a seasonally adjusted 151,000 jobs in February, the Labor Department reported Friday, slightly below the gain of 170,000 jobs economists polled by The Wall Street Journal expected to see.

That was better than the 125,000 jobs added in January.

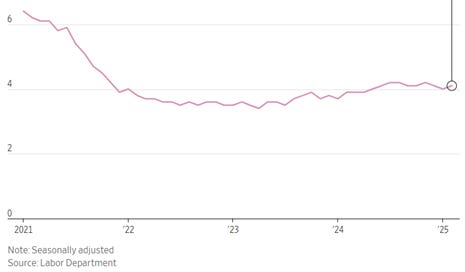

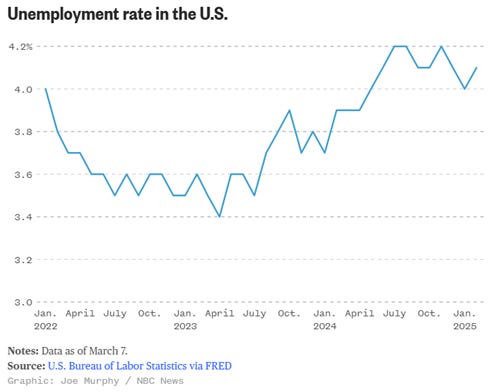

Unemployment rose from 4 percent to 4.1 percent in February, and the number of people who are unemployed remained largely unchanged at 7.1 million. That indicates a steady jobs market since late 2021, as a graph in the Journal story illustrates:

Source: The Wall Street Journal

Note that NBC News clipped the graph by shortening the time scale and squeezing it vertically, to suggest much greater change:

Source: NBC News

That is bad journalism and rank dishonesty.

A closer look at the numbers shows that things are largely where they have been for the past couple of years. The federal government cut 10,000 jobs as the beginning of cuts suggested by the Department of Government Efficiency, with many thousands more to be shown in the next monthly employment report. The federal job reduction was the first since June 2022.

The NBC News story characterized the February jobs report as the final thrust of the great economic dynamo brought to us by President Joe Biden:

Samuel Tombs, chief U.S. economist at Pantheon Macroeconomics, all but dismissed the BLS report as “a snapshot of a prior age, before the shift in federal government policies undermined confidence.” …

“There were fears that today’s jobs report would reveal some deeply unsettling news around the health of the labor market,” Seema Shah, chief global strategist at Principal Asset Management, said in a statement Friday. “Yet, while the worst fears were not met, the report does confirm that the labor market is cooling.”

Ah, we shall miss that sweet, sweet Biden economy, the NBC News analysts argue. Trump is ruining our economic utopia, the story argues (instead of sticking to reporting the news, fat chance):

Less than two full months into office, Trump has whipped up storm clouds for the otherwise solid economy he inherited, promising to overhaul it to address voters’ widespread discontent.

Trump is destroying the economy by increasing the fear factor, the story argues:

Wall Street traders and analysts have increasingly sounded alarms about the impact of policy uncertainty on the economy. But market reaction to Friday's report was relatively muted. Stocks are likely to close down for the week, having fully erased the gains accrued since Trump won re-election in November.

“We are likely to see some headwinds as we move through the year,” Sarah House, Wells Fargo senior economist, said Thursday ahead of the BLS report. “It’s not just tariffs we’re contending with but also slower immigration. That’s going to affect labor force growth, and then we now have pretty aggressive efforts to curtail government spending.”

Consumer confidence has taken a downturn as households shift more focus from spending toward saving. Meanwhile, the combination of Trump’s still-evolving tariff agenda and the massive job cuts sought by Musk, his multibillionaire adviser, have raised the twin specters of higher unemployment and higher prices, with increasing invocations of stagflation.

As that comment indicates, investors and analysts supposedly fear that Trump tariffs will “unleash” inflation, that Trump-imposed slower immigration will shrink the labor force, that government spending will decrease, and that people will save more and spend less.

I do not see any excuse for characterizing that as “uncertainty.” The consensus claim among the mainstream media and the analysts they quote are that Trump will create an economic disaster, reversing the magnificent achievements of the Biden administration. It would be beneficial if the “reporters” and analysts would just say that outright, so that we may compare their forecasts to the reality down the road. Of course, they do not do that because they don’t want to be caught out as phonies.

The trends and policies mentioned in the NBC story are in fact beneficial to the American people. Let’s consider them in turn.

Trump’s statements about tariffs have been all over the place, with the president providing multiple suggestions about what they would do. Trump’s goal is clear, however: to use tariffs to force other countries to open their markets to American goods and services. Trump stated that explicitly in his recent speech to Congress, and he added that he would like to impose reciprocal implementation of other barriers to trade, to end them as well. (All of that should have been a major news story, instead of the bizarre and childish news-media focus on the silly and embarrassing protest stunts by Democrats.)

What Trump is proposing would be true free trade, quite different from our decades-long surrender to other nations’ restrictions. It is obvious that greater access to foreign markets would be terrific for American workers and investors and also for those who depend on government income-support programs. Everybody, in fact.

The argument being made against Trump’s proposed tariffs is a simple and important one: that they would not force the European Union and other miscreant governments to open up their markets to U.S. goods and services and would instead result in “tariff wars” in which nations “harm only themselves” through “economic isolationism.”

Trump’s response is that the United States is already suffering great harm from other nations’ tariffs and has conceded defeat instead of fighting back. That is certainly true, as that is the very course that his critics advocate, though they argue that it is beneficial to the United States, not harmful. It is thoroughly clear, however, that the current system, in which the United States makes all the concessions and other countries rake in our money, does not benefit U.S. workers.

U.S. investors are surely benefiting from this, as capital flows across borders vastly more freely than workers can, and U.S. workers would have to take awful pay cuts for the privilege of working in those countries. The benefits that this unfree, unfair trading system gives to U.S. investors are a massive transfer of income and wealth from workers to investors—from lower-income people to higher-income people. Inequality been increasing in the United States for more than four decades now:

(The “Gini index measures the extent to which the distribution of income or consumption expenditure among individuals or households within an economy deviates from a perfectly equal distribution,” the St. Louis Fed’s explanation for the chart notes.)

Trump’s proposed tariffs would not be historically severe; in fact they would be mild, as this chart from Statista indicates:

Trump says he wants to deploy tariffs to reverse the rise in inequality in the United States. That would surely be a good thing. Others say that it will not work. Without claiming a direct causal relationship between free trade and inequality, my assessment is that mirroring other nations’ tariffs against U.S. goods and services is well worth a try and that Trump’s motivation for the policy is eminently defensible.

Moving on to the next claim, the argument that a slowdown in immigration will shrink the labor force, and that this would be a bad thing, presumably reflects a belief that reducing the number of workers will lower overall economic output. There is a big problem with that claim: a large number of those people being laid off from their (cushy, greatly overpaid) federal jobs will be looking for employment.

There will not be a one-to-one replacement of erstwhile immigrant criminals working for under-the-table payment, of course. Insofar as they are replaced by U.S. natives, however, it will tend to push up wages. Government jobs averaged 28 percent of total U.S. job additions in 2023 and 23 percent in 2024. The entire net increase in jobs in 2024 went to immigrants. Native-born Americans lost jobs.

The Federal Reserve will worry about this because the central bankers believe that wage increases cause inflation, but the reverse is true: inflation pushes up wages (though generally by less than prices rise). Without undue increases in the money supply, higher wages reflect higher productivity and generally fall significantly short of the improvements in the latter.

The good thing about the underwhelming February jobs report is that it will keep the Fed from panicking about there being too many people working in the U.S. economy and start pushing up interest rates to head off the inflation this will supposedly cause. Fed Chair Jerome Powell said as much, stating the central bank will “wait for further clarity” on the state of the economy. Interestingly, Powell downplayed the supposed inflationary effect of tariffs.

Ultimately, it appears to me that the worry about a slowdown in immigration is based on the same premise as the tariff “concern”: that income and wealth would shift mildly from high-income, wealthy people to workers. Why that is something we should all oppose is hardly obvious.

The concern that Americans are suddenly saving too much is presumably based on the (false) premise that consumption drives the economy and saving thus hogs up good money that could be spent on more gimcracks from China. That is not what has happened lately. Although the savings rate increased in January, the change reflected only a very small decrease in personal spending, as personal income rose by a lot. CNBC reports,

Personal income posted a much sharper increase than expected, up 0.9% on the month against expectations for a 0.4% increase. However, the higher incomes did not translate into spending, which decreased 0.2%, versus the forecast for a 0.1% gain.

The personal savings rate also spiked higher, rising to 4.6%.

The notion that saving is bad is pure, dumb Keynesianism. Saving money may reduce consumption below what it would be otherwise, but that merely indicates that people expect more happiness and wealth from saving the next dollar than from spending it, at this point in time. More saving means an increase in investment: the money has to go somewhere, and when you save it, banks lend it to people.

Similarly, the belief that cutting government spending will harm the economy is further Keynesian claptrap. Government spending and regulation are a drag on the economy. Period. Reducing them, as Trump proposes, will accelerate economic growth. That is something to celebrate, not to worry about.

Finally, with the stock markets having fallen lately, CNBC and other legacy media outlets are arguing that fears of tariffs are driving the decline:

U.S. President Donald Trump expanded his tariff pause to goods coming in from Canada and Mexico, so long as they satisfy terms of the United States-Mexico-Canada Agreement, a trade deal between all countries.

Unlike Trump’s Wednesday reprieve to automakers, which bumped up stocks, investors weren’t relieved this time. All major U.S. benchmarks sank, with the Nasdaq Composite limping into correction territory and losing its post-election Trump bump.

That might be because the Trump administration seems to be doubling down on tariffs, even as it acknowledges—and dismisses—the repercussions of such levies.

So, equity values fall, and tariffs must be to blame because … because … well, just because. CNBC’s logic, if you can call it that, is interesting. Pausing tariffs for a sector of the economy “bumped up stocks,” but after pausing them for much more of the economy, “investors weren’t relieved.” That is because “the Trump administration seems to be doubling down on tariffs”—by pausing them?

Stocks headed back up the day after CNBC ran that article, after a morning sell-off, all presumably because tariffs, right? The obsession with Trump’s tariff policies is beginning to look a lot like “I don’t like them because he likes them.”

The economy is in fact in precarious shape, and conditions are very strange and confusing. The cause of the trouble is obvious to anyone who is willing to see it—and it is not fear of tariffs. It has all resulted from the massive overspending, overregulation, and debt expansion imposed during the Biden years, as I have been reporting regularly. The remedy is to remove those distortions and get back to a pre-Covid level of taxes, spending, and regulation as soon as possible. And then, cut all those distortions further.

The budget reconcialiation passed by Congress and signed by President Trump sets up the opportunity to extend the curent tax rates beyond the end of this year; otherwise, they will expire and tax rates will rise significantly. Another tax increase would be disastrous. A massive tax increase would be a catastrophe. The worst thing the federal government could do would be to allow any further delays in extending the 2017 tax-rate cuts. That is what has been causing all the uncertainty.

As always, this is EXTREMELY helpful, Sam. I don't understand all that Trump is doing in terms of economics, but you give me hope.

Thanks, Brad!

This is a very tricky and murky situation (caused entirely by the foolishness and perfidy of the previous president and the Congress of his first two years in office). I think that I understand what Trump and Speaker Johnson in particular are up to, which I have written about a few times since the inauguration. If I am wrong and what I have been thinking of is not their plan, that would mean that I am cleverer than they, which I am absolutely not. So I believe that there is reason for hope, lol.