Mixed Signals from the Economy

Longer-term, underlying trends indicate economic problems caused by the economic and immigration policies of the past four years. Tax, regulation, and spending cuts are essential.

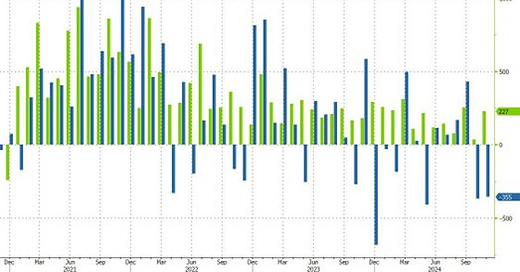

After struggles in October, job growth in November was higher than expected. Or was it?

First, from Trading Economics:

The US economy added 227K jobs in November 2024, marking a strong recovery from the upwardly revised 36K gain in October, which was heavily influenced by Boeing strikes and the disruptions caused by Hurricanes Helene and Milton. Figures came better than forecasts of 200K, as employment trended up in health care (54K), leisure and hospitality (53K), government (33K), and social assistance (19K). Also, employment increased in transportation equipment manufacturing (32K), reflecting the return of workers who were on strike.

Most of those jobs, 138,000 out of 227,000, were in government, health care (which is highly subsidized and thus reflects much more government spending), and social assistance, plus jobs restored to strikers and returnees after the hurricanes, which do not represent a net long-term gain in private-sector output.

Meanwhile, the household survey told a very grim story, with reported employment decreasing by 355,000:

Source: ZeroHedge

Those are jobs reported by workers.

Economic output looked very good in November, as measured by the S&P Global US Composite PMI Output Index:

The PMI, however, includes both manufacturing and services, and all the growth was in services, Trading Economics notes:

The reading indicates a strong monthly rise in overall output, driven primarily by the services sector (PMI at 56.1), while manufacturing output continued to decline (PMI at 49.7). However, there were signs of demand stabilizing in manufacturing. The combination of robust growth in services and improving demand lifted overall new orders to their highest level in two and a half years. Meanwhile, output prices increased at their slowest rate in four and a half years.

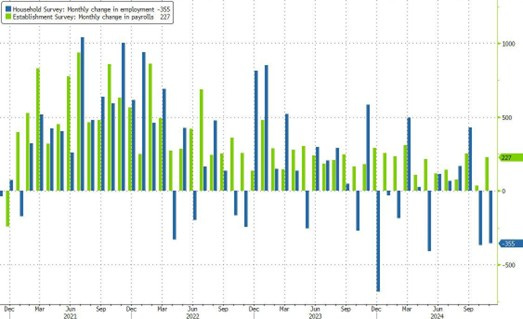

In addition, initial jobless claims rose to 224,000 in the week ending on November 30, up from 213,000 the week before. Two weeks earlier, “outstanding claims rose to 1,907,000 …, the most since November 2021,” Trading Economics notes. The unemployment rate rose slightly to 4.2 percent, up a tenth of a percentage point:

Source: ZeroHedge

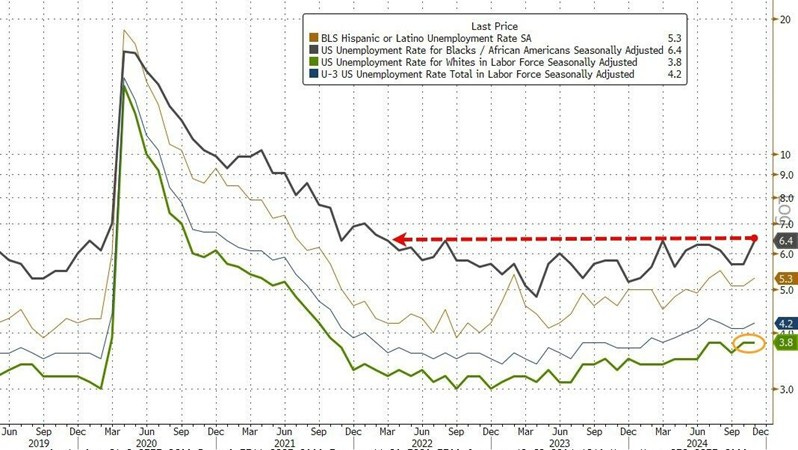

Job losses in manufacturing confirm the decline in that sector. ZeroHedge quotes ADP Chief Economist Nela Richardson as stating, “Manufacturing was the weakest we've seen since spring. Financial services and leisure and hospitality were also soft.” The November loss of 26,000 manufacturing jobs was the worst since June 2023, ZeroHedge notes:

Even so, the jobs market seems strong, Trading Economics reports: “Despite this rise, the results still support the view that the US labor market remains at historically strong levels.”

ZeroHedge confirms this conclusion:

Worse still, wage growth starting to rise again (after unions scored huge wage increases).

· Job-changer wage growth rose to 7.20% YoY from 6.70%, highest since August.

· Job-stayer wage growth 4.80%, highest since June; year-over-year pay gains for job-stayers edged up for the first time in 25 months

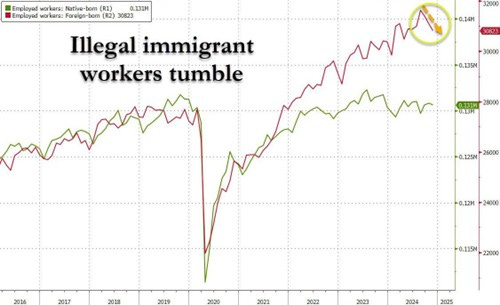

The wage increases may mark a turn to a new long-term trend toward higher labor costs, as they seem to reflect a move away from criminal aliens to native-born or naturalized U.S. citizens. ZeroHedge reports:

Finally, for those trying to figure out what all this means, here is perhaps the most important chart: after hitting a record high in August, the number of illegal alien workers has tumbled (even as native-born workers remain flat). This suggests that wage growth is about to surge as employers will now be “forced” to hire domestic employees, who unlike their Guatemalan peers, have the ability to negotiate higher wages

Wages are rising though job growth is low. The rising wages will stoke the Fed’s fear of a resumption of inflation, while stagnant job numbers indicate the economy could use a boost.

This is not stagflation by any means, at least not yet. However, it suggests that the Federal Reserve will be cautious about interest rate reductions even though the economy appears to be slowing. The mixed signals will allow the Federal Reserve to do whatever it wants about interest rates at its December meeting, as it will be able to find numbers to support its choice, whether it be a small rate cut or a decision to stand pat for the month.

Longer-term, underlying trends, however, indicate economic problems caused by the economic and immigration policies of the past four years.