Harris’s Housing Problem

The rapid rise in the cost of housing is entirely at Kamala Harris's doorstep and that of President Biden.

The high cost of housing is a big problem for the presumptive Democrat presidential ticket.

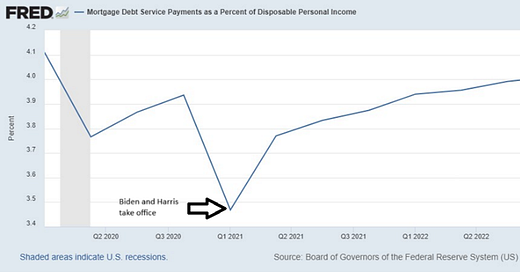

Inflation raised rental prices and the nominal monetary value of the housing stock across the nation during the Biden administration, while the high interest rates the Federal Reserve imposed to slow the devaluation of the dollar further increased the costs for new homebuyers. Average household debt service payments as a percent of disposable personal income rose from 3.47 percent in January 2021 to 4 percent in the first quarter of 2024:

Home purchase prices reached record highs this year. “Home-buying affordability dropped last fall to the lowest level since September 1985, and it fell near that level again in June,” The Wall Street Journal reported on Friday. New home sales crashed accordingly, declining by 14.9 percent in May.

Rental prices rose rapidly as well. “The rent-to-income ratio has increased from about 27.5% to 30.1% over five years,” Yahoo! Finance reports on a study from BadCredit.org. “Rent has increased by 32.6% over five years, while the median income has increased by only 20.8%.”

Unsurprisingly, “Housing costs have emerged as a key concern for Americans as the real estate market contends with the double-whammy of high mortgage rates and a dearth of supply, pushing the cost of owning a [sic] 26% higher than it was in 2020, according to a recent Redfin analysis,” Newsweek reports. “With many would-be buyers on the sidelines, the effect has been a red-hot, competitive rental market that has further pushed up prices.”

As a result of all this, “Housing is one of the thorniest economic issues facing [Vice President] Harris, with voters naming the cost of rent and high mortgage rates as a growing concern,” The Wall Street Journal reported on Friday.

All this trouble and woe could have been avoided quite easily. The inflation was caused by excessive federal spending—and consequent massive increase in federal debt—enacted in 2021 and 2022 by the Biden-Harris administration and Democrat-controlled Congress with no Republican yes votes on most of the legislation.

President Joe Biden never considered cutting spending, and Harris was in lockstep with his overspending agenda. Instead, when Biden finally decided to address housing price inflation in July of this year, his proposed solution was a big increase in federal interference in the housing market.

“President Joe Biden has proposed federal rent control measures, saying they’re needed to protect tenants from corporate landlords,” Newsweek reports. “He proposed limiting rent hikes to 5% a year for the next two years for landlords with more than 50 units.”

Biden also called for “a new $10,000 tax credit for first-time home buyers and providing as much as $25,000 in down-payment assistance for first-generation home buyers,” the WSJ noted.

Harris has echoed those ideas on the campaign trail. Harris “recently indicated support for [national] rent controls, saying at her first major rally since becoming the nominee that she wanted to ‘take on corporate landlords and cap unfair rent increases,’” Newsweek reports. “In 2019, after Oregon passed a statewide rent control measure, she praised the bill on Twitter.”

On Friday, Harris added to the Biden plans for more government intervention in the housing market, calling for the construction of three million new housing units in the next four years and proposing “a new tax incentive for companies that build homes for first-time buyers,” the WSJ reported. Biden had called for the building of two million new homes.

In addition, “Harris will propose a $40 billion fund to help local governments develop innovative solutions to the lack of housing supply. It is an expansion of a similar $20 billion fund proposed by the Biden administration,” the WSJ noted.

Harris even proposes telling landlords what software they can use.

“She will also endorse legislation that would crack down on the use of property-management software that has allegedly been used by landlords to fix apartment rent prices at buildings across the U.S.,” the WSJ reported.

All of this, of course, is the standard progressive-left response to any problem that may arise: more restrictions on the people.

None of these proposed interventions are needed, and all of them would be enormously destructive.

The right way for government to relieve a housing shortage is simple: remove the government rules that are the cause of the problem.

Argentina had vastly worse housing problems than the United States just a few months ago. The country had suffered decades of inflation and long bouts of hyperinflation under democratic-socialist governments. The inflation led to extremely high interest rates to compensate for the ongoing currency devaluation—the key interest rate of Banco Central de la República Argentina rose to 97 percent in May of last year.

“Argentina’s very high inflation rates made granting peso-denominated mortgages too risky for banks,” Global Property Guide (GPG) reported in August 2023. “In 2015, the number of new mortgages in Argentina slumped to its lowest level in 15 years, accounting for just 1% of the country's total GDP—the lowest in Latin America, according to a recent report by the Housing Finance Information Network. This was down from 5.4% in 2000.”

In 2017, the Argentine government offered subsidized mortgages “to around 90,000 locals with monthly incomes ranging from ARS 16,000 (US$69) to ARS 32,000 (US$138),” GPG reported. It did not help: “During 2022, the size of the mortgage market was equivalent to just about 0.5% of GDP, down from 1.52% of GDP in 2018 and 5.36% of GDP in 2000,” GPG reported.

In addition, the Argentine government imposed rent controls nationwide, with a 2020 law capping rent hikes and security deposits, requiring leases last at least three years, and making it extremely difficult to evict nonpaying tenants. The government also forced owners to accept pesos instead of dollars. Landlords could not afford to rent out their apartments, because the country’s high inflation rate and restrictions on rent changes meant the rent they received would rapidly decrease each month. Apartment rental prices in Buenos Aires rose by 64 percent in 2021.

Landlords increasingly left apartments vacant, evidently awaiting better times. An estimated one in seven homes in Buenos Aires was untenanted at the end of 2023.

Better times arrived with the election of libertarian economist Javier Milei to the country’s presidency in November 2023. The Milei government removed the rent controls on December 29, and “Buenos Aires saw a doubling of available rental units, and rental prices have stabilized,” Newsweek reports. “Under the new rules, landlords and tenants have more freedom to agree on lease terms. If the duration isn’t specified, it defaults to two years.”

With the removal of rent controls, the housing supply expanded rapidly as landlords were once again able to rent apartments that had been sitting empty. “The supply of rental housing in Buenos Aires has jumped by 195.23%, according to the Statistical Observatory of the Real Estate Market of the Real Estate College (CI),” Newsweek notes.

Government intervention to manipulate the housing market always backfires, as the experience in Argentina shows and in fact has been confirmed all around the world. If there is one thing economists of all stripes generally agree on, it is that rent controls do not work. The same is true of other government intrusions into the housing market and other areas of the economy, including those Harris is proposing.

It is important to remember that the Constitution does not authorize Congress or the president to mess about with the housing market. No president should sign any bill that does so in any way—much less propose such unconstitutional actions. Note that the Supreme Court’s perversion of the Interstate Commerce Clause starting in the 1930s does not make such intrusion constitutional. It simply means the president is the only national entity available to defend the public from such unconstitutional measures passed by Congress.

These interventions are feckless in addition to being unconstitutional. “Biden and Harris, like previous presidents and vice presidents, are limited in their ability to significantly lower housing prices, because housing costs are influenced by interest rates and the supply of and demand for homes,” the WSJ notes. “Both factors are largely out of their direct control.”

Technically that is true, but in practical terms it is dead wrong. Presidential actions have an enormous effect on interest rates and the housing market, through federal debt.

What is in the direct control of a U.S. president is federal spending.

It just so happens that excessive federal spending and an enormous addition to the national debt created this housing “crisis” in the first place. Biden could have prevented that by honorably vetoing those spending bills, but instead he encouraged their passage and complained they were not even more extravagant and wasteful.

As president, Harris would have full power to prevent further profligacy and in fact reverse the foolish overspending imposed by previous Congresses and presidents over the decades. Instead, Harris proposes to worsen this problem and countless others by doubling down on Biden’s irrational, unconstitutional, and enormously damaging spending spree.