Economic Data Are Looking Better

Industry growth is improving, interests rates are falling, and inflation remains a little above the Fed's target. Ph.D. economist Robert Genetski explains what it all means.

Guest post by economist Robert Genetski, Ph.D.

Unlock exclusive financial insights and expert analysis to navigate market trends and make informed investment decisions: subscribe@classicalprinciples.com.

Encouraging signs are beginning to show up in the economic data for July and August. Among these signs are (a) the August business surveys, (b) a jump in new orders after removing the effect of erratic aircraft and defense, and (c) the ongoing

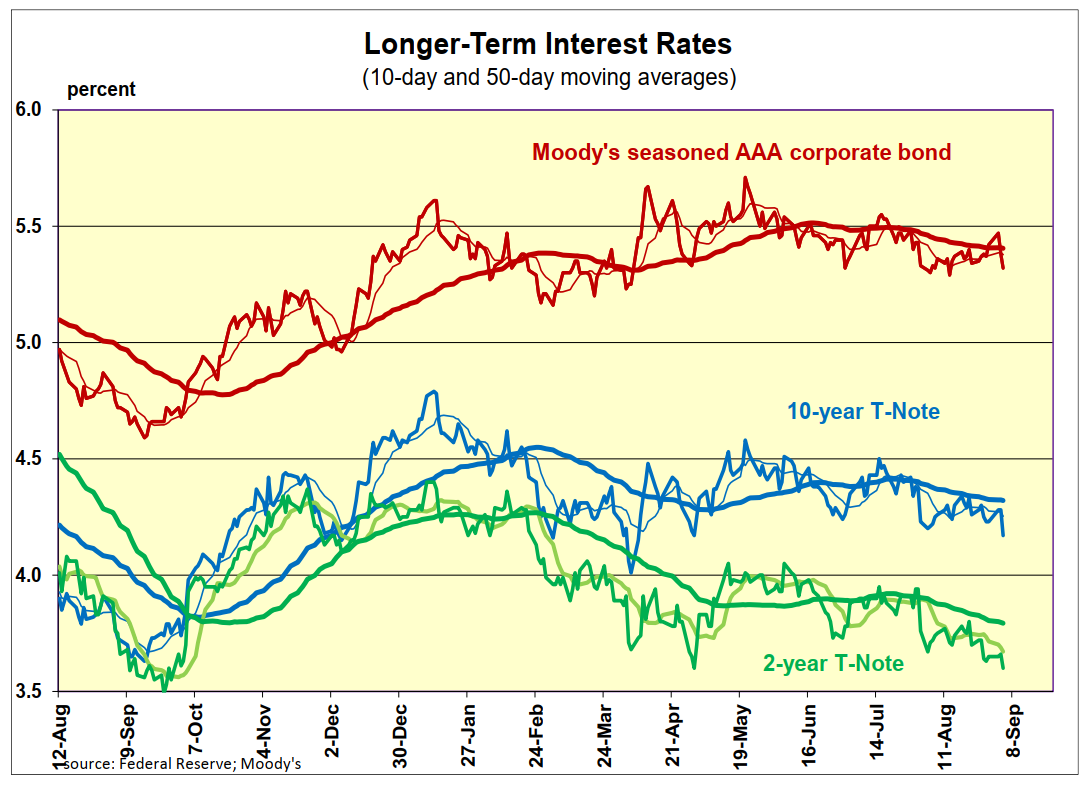

downward move in longer-term interest rates.

The chart below shows longer-term rates remain below their 50-day moving averages, a technical signal that often corresponds to more downward pressure on rates.

The private ADP payroll report, which often provides a more reliable guide than the

government shows August job gains were only 54,000. The latest government payroll report confirmed a slowdown, with total payrolls growing slowly, if at all, since April.

Although the employment numbers are weak, employment is a lagging indicator. It is more important to look to reports on new orders to determine where the economy is

heading.

The August business surveys are moving closer to agreement. Both ISM and S&P report weakness in manufacturing. The S&P reported only a slight decline, and ISM showed a bit more of a decline. In the key service sector, which dominates the economy, the S&P survey continues to show decent growth, with a reading near the mid-50s.

There was a substantial improvement in the ISM surveys, which went from a negative 49 to a positive 52. Also, new orders jumped from 50 in July to 56 in August.

Both surveys show declining employment and sharp increases in prices.

July manufacturing shipments and orders were mixed. Shipments for the month were up at a sharp 11 percent annual rate, but new orders fell sharply after a boom in orders for aircraft and defense.

In a more encouraging sign, July new orders excluding the volatile aircraft and defense components rose at a 14 percent annual rate to a new all-time high.

The government report on wholesale prices will arrive tomorrow. The August business surveys have shown sharp increases in wholesale prices. We suspect the August wholesale price reports will reflect these increases.

On Thursday the August CPI data could raise questions about the advisability of a Fed rate cut. The Atlanta Fed estimates total CPI and core will show increases of 0.3 percent and 0.25 percent. Those are annual rates of 3.7 percent and 2.8 percent, respectively. If accurate, the year-over-year inflation rates would be 2.9 percent and

3.1 percent.

Although the inflation rate should be moderated by the 6 percent decline in oil prices in August, wholesale price increases have been very strong. This is probably why forecasts are calling for inflation to continue in the 3 percent to 4 percent vicinity despite the decline in oil prices.