Cost of Trump Tax Cut Extension: $0 or Less

Tax-rate cuts are not tax cuts. They increase federal revenue. Congress should stop pretending that people do not change their behavior when you tax them more.

The most destructive and silly aspect of the debate over the upcoming federal budget is the insistent claim that extension of the 2017 tax rates into the future would “cost” $4 trillion over the next 10 years, increasing the budget deficit by an average of $400 billion per year.

Those are estimates by “independent analysts” and “nonpartisan forecasters,” plus some Republican “deficit hawks” in Congress, Reuters reports.

They are wrong.

The federal government is currently receiving revenue of almost exactly the same percentage of GDP as has been the norm since the end of World War II: 17.3 percent of GDP today, with the normal amount being 17.4 percent.

Federal revenue as a proportion of GDP always hovers within a percentage point or so of that 17.4 percent average, no matter what tax rates and new taxes Congresses and presidents impose. It is an iron law, as my forthcoming paper from The Heartland Institute demonstrates.

Reuters quotes a prominent GOP senator to that effect:

“Where is the increase in the deficit?” Senate Finance Committee Chairman Mike Crapo told reporters this week. “The revenue to the Treasury is about 17.3% of GDP right now. If we do nothing except extend the act, the revenue next year will be a little higher, the way revenue is coming in.” …

Asked about independent analyses that say the tax cut extension could add $4.8 trillion to the nation's debt over a decade, Crapo, of Idaho, replied: “It's a mathematical calculation based on assumptions that we're saying are invalid.”

Crapo is right. Those assumptions are invalid. They are based on the notion that raising tax rates on people will not change their economic behavior appreciably. History, by contrast, shows that increases in tax rates suppress economic activity and cuts in tax rates grow a nation’s economy.

Extending the Trump tax rates will not reduce tax revenues as a percentage of GDP, which is the only number that counts. The only way to raise tax revenues is to increase the output of the U.S. economy, and the only way to do that is by cutting taxes, not raising them, plus reducing federal regulation and cutting (or eliminating) welfare payments and other policies that discourage participation in the private-sector workforce.

The data show very clearly that extending the 2017 tax rate cuts would not cause the predicted shortfall of $4 trillion in tax revenue over the next 10 years. In fact, it is obvious that failing to extend the current tax rates would reduce revenues well below projections and cause even greater federal budget deficits.

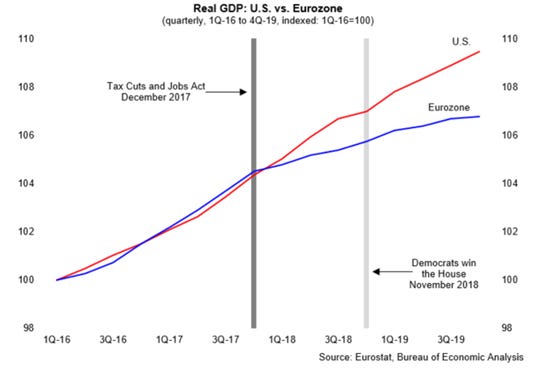

Trump’s 2017 tax “cuts” resulted in increased tax revenues, as this chart from Unleash Prosperity shows:

What caused this bizarre miracle? Economic growth, as another Unleash Prosperity chart shows (and as I have noted regularly here and elsewhere):

The obvious conclusion is that ending the Trump tax-rate cuts of 2017 would decrease federal tax revenue as a percentage of GDP, and extending them would keep tax revenues stable at worst and would in fact almost certainly increase GDP and federal revenues. Further tax rate cuts would increase federal tax revenues even further.

As a rule, I do not want the federal government to be taking more money from the American people. I approve fully, however, if it is accomplished through greater freedom and a lower relative burden on each taxpayer as the economy grows to accommodate whatever spending on which the federal government insists.

The point is that tax rate cuts benefit everybody, including the greediest people of all: the government.

That is why the Republican leaders in the House of Representatives are right to tie increases in military spending, border security, and energy into one “big, beautiful” budget reconciliation bill, and the Senate is dead wrong to prefer two bills, one to increase spending first and then one to extend the 2017 tax rate cuts.

What the Senate is proposing is the usual Washington, D.C. process, and it is how we got into the current catastrophic spending-and-debt spiral that will destroy the federal government within the next seven or eight years if it continues: promise to cut tax rates after increasing spending, and then fail to cut tax rates. Then say, “Well, we tried.”

President Trump is not falling for the Senate GOP’s RINO offer to surrender to proponents of colossal government:

Trump is right. The process always should be to cut tax rates first and then to increase spending when the greater revenue starts to arrive—or better yet, pay down the government debt, which reduces inflation and upward pressure on interest rates. “One big beautiful bill” is definitely much better than “pay now for inevitably broken promises of future cuts in tax rates.” Best of all by far, however, is this: “cut spending now, cut tax rates now, and pay down debt now.”

It’s much more enjoyable to spend money than to earn it, of course, and it is much easier for politicians to lure votes by giving things to people than to promise not to take things away from them next year (which is what cutting tax rates does). The Biden administration took that to the extreme, openly buying votes from Democrat constituencies and punishing Republican voters, thus creating brutal budget deficits, as a chart in another article from Unleash Prosperity shows very well:

Federal spending increased by an amazing 15 percent in FY 2025, rising by $317 billion, according to the Congressional Budget Office (CBO), when the economy was growing, according to government reports. Meanwhile, the CBO expects receipts for the fiscal year to rise by 11 billion dollars over those from 2024, or 1 percent year-over-year.

Summary: federal revenue increased a little, and spending increased by a lot. That was the result of President Joe Biden’s last year in office.

Major spending increases were in Social Security (7 percent, because of the cost-of-living raise necessitated by Biden’s inflationary fiscal recklessness), Medicare (5 percent, ditto as to effects of Bidenflation), Medicaid (9 percent, ditto plus enrollment increases due to the ongoing effects of Biden’s cancelation of Trump’s modest cost-saving measures), refundable tax credits (i.e., welfare via recovery rebates, earned income tax credit, child tax credit, premium tax credits, and the American Opportunity Tax Credit; a 29 percent rise), and a 13 percent increase in interest on the public debt.

In addition, Homeland Security spending rose by 43 percent in response to Hurricanes Helene and Milton, for which Biden was not responsible as far as I know, although he did emit a record-breaking amount of hot air.

The reported budget deficit in December 2024 alone was $87 billion. The estimated deficit for January 2025 alone is $127 billion.

This is a spending problem, not a revenue problem. The Washington, D.C. establishment has not respected the notion of living within the nation’s means since the end of Newt Gingrich’s tenure as Speaker of the House in 1999.

The only rational response is simple: cut spending.