‘Big and Beautiful,’ but Not Nearly Enough of Either

The Big Beautiful Bill is fine, as far as it goes. Yay to that. The nation, however, needs much more action from Congress to avert a fiscal catastrophe. A couple of charts tell the story.

The U.S. House of Representatives passed the 1,118-page “Big Beautiful Bill” to extend the 2017 tax cuts and implement a variety of other tax and government policy changes by a 215-214 vote on Thursday.

The closeness of the vote indicates the intransigence of Democrat opposition to reform and explains why the bill could not achieve much more than an urgently necessary first step in a rescue of the nation’s economy and the viability of the federal government.

“The multi-trillion dollar tax break package contains numerous elements of Trump’s far-reaching agenda and has been delivered via an all-night session,” Breitbart reports. “These include extending tax cuts passed in 2017, eliminating taxes on tips, spending more on defence and border security, while making government health care programs more accountable.”

The stock markets fell in response to fears about a big increase in the federal deficit the Congressional Budget Office predicted the legislation would cause.

The bill now goes back to the Senate for adjustments to bring the two chambers’ versions into alignment so that both houses can vote on a final version.

The “big beautiful bill” was an absolute necessity. It averts a $4 trillion federal tax increase that was scheduled to arrive on the first day of 2026. That would have been catastrophic, as siphoning an additional $4 trillion from the productive sectors of the economy would have to be.

Notice that the $4 trillion was a measure of the expected effect of the higher tax rates, which would have been a dead loss for the economy by transferring that money from productive people to the government. Expiration of the 2017 cuts would have added about $2,500 to the annual tax bill for middle-income households. The higher rates, moreover, would not have raised the expected revenues. They never do, because higher tax rates discourage people from doing the things that would raise those revenues. People work less, invest less, and produce less when the government taxes a greater share of the fruits of their efforts.

Every Democrat voted against the bill, which meant that each and every one of them voted for a brutal tax increase, the largest in the nation’s history, which would have placed an appallingly costly new burden on families across the country. The House Democrats relied on Republicans to bail them out of the catastrophic consequences of their irresponsible performative opposition to a desperately needed tax reform.

Democrats argued that the bill would increase the federal debt by $4.6 trillion between 2026 and 2034, averaging a deficit increase of $463 billion per year, citing estimates by the Congressional Budget Office. The CBO always vastly overestimates the take from tax increases and underestimates the positive economic effects of tax cuts. “That forecast borders on economic malpractice,” write the good people at the Committee to Unleash Prosperity. They provide a chart showing how poor a forecaster the CBO is:

We know CBO and the Joint Committee on Taxation are wrong, because this same model overestimated the revenue loss of the 2017 Trump tax cut by $1.5 trillion in the first five years of the bill. That’s a gross error.

After decades of complaining about the [Joint Committee on Taxation] and CBO’s erroneous models, which ALWAYS overestimate the “cost” of tax cuts, they still refuse to fully take account of the economic benefits of lowering tax rates. It’s like a doctor tapping a patient’s knee and not expecting the leg to kick up.

The CBO is wrong this time too. There is no way that the biggest tax increase in history would cut the deficit; it would slam the brakes on the economy. Averting that tax increase will have the opposite effect: a booming economy and higher federal revenues from that bigger pie. The Big Beautiful Bill will decrease the federal deficit, not increase it—provided that Congress does not increase spending in the meantime, which, alas, is more likely than not. We can trust Trump to continue reducing regulation and cut restrictions on energy production, which will further increase economic growth.

In any case, the Democrats’ complaints would have more credibility had they not increased the federal deficit by one-third, or $450 billion per year, between 2022 and 2024.

That is almost exactly the same as the highly implausible $463 billion per year increase the CBO projects for the Big Beautiful tax cut extensions. It is obvious that the Democrats’ opposition to the bill is not based on a sudden onset of fiscal probity. The Democrats’ effect on debt payments was brutal, notes Heritage Foundation Research Fellow E. J. Antoni in a commentary at TownHall:

When Trump left office, interest on the debt cost about $600 billion a year. Biden managed to nearly double that, with interest payments exceeding an annualized $1.1 trillion by the end of his term—exceeding all defense spending combined.

It is tempting to see the Democrats’ opposition to the Big Beautiful Bill as based on a determination not to let President Trump get a legislative victory. It is likewise possible that they acted on the belief that sticking Trump and the Republicans with the consequences of the largest tax hike in history would benefit the Democrats politically in next year’s elections. Inflicting great harm on the American people as a political ploy is an obviously awful thing, yet it is entirely believable based on the left’s delight in and history of Cloward-Piven destruction, as evidenced vividly by the Covid lockdowns, mass riots, and election chaos in 2020.

The worst possibility is that the congressional Democrats actually believe imposing the biggest tax increase in history would not harm the economy or the American people. Such a gross delusion seems to me to be even more dangerous than a cynical political calculation would be. Any way you look at it, however, the party’s unanimous support for the biggest tax increase in history is grievous, irresponsible, and unforgivable.

Even though the Big Beautiful Bill is absolutely necessary in averting the biggest tax hike ever, it is far from sufficient to repair the fiscal damage of recent years. While averting a tax disaster, the Big Beautiful Bill fails completely on the spending side. QTR’s Fringe Finance outlines the problem:

GOP opponents of Trump’s new spending bill argue that it adds too much to the national debt and doesn’t include enough spending cuts to balance it out. They’re concerned it could worsen inflation and say the government is trying to take on too much instead of leaving things to the states or private sector. Some also believe the bill is filled with unnecessary items and lacks clear focus. Overall, they see it as fiscally irresponsible and a step away from conservative principles of limited government and careful budgeting.

Last night Rep. Thomas Massie (R-KY) opposed Trump’s bill, calling it fiscally reckless due to its mix of tax cuts and increased spending. He warned it would add trillions to the debt and criticized the rushed vote on a still-unfinished bill. Despite pressure from GOP leaders and Trump, Massie voted no, underscoring deep divisions in the party over fiscal policy.

Massie correctly pointed out that investors continue to demand higher yields on U.S. bonds, signaling a loss of faith in the creditworthiness of the United States.

The unusually low prices of U.S. government bonds are a very ominous sign of federal fiscal disarray, Fringe Finance notes:

For lack of more complicated jargon, the bond market has recently been “out of whack”. Yields are rising despite the Federal Reserve being in the middle of a cutting cycle, and bonds sold off at the same time risk assets sold off after Liberation Day (they would usually catch a bid in a ‘flight to safety’ selloff). If it feels like the magnetic poles of the bond market have reversed, it could be because they have.

Bond buyers value reliability, Fringe Finance notes. A drop in bond prices increases interest rates and signals concerns about the stability of the bond issuer, in this case the U.S. Treasury:

The bond market has traditionally been comprised of far more sophisticated and sizable investors than the equity market: foreign governments, giant institutions, and extremely wealthy investors, to name a few.

As bonds sell off with risk assets and as yields rise despite the Fed cutting rates, these influential and sizable investing world powers that be are sending the message that things are not OK the way they are going. The rising yield indicates a desire to be compensated more for holding U.S. debt—sending the signal that it is riskier than people think it is—and it also sends a message to our Treasury and the Federal Reserve that the country’s fiscal house is not in order.

The bond market is, in essence, a collection of investors so sharp that they can’t help but realize exactly how precarious the country’s financial situation has gotten, no matter how much of a polish or gloss politicians and government officials try to put on it. In other words, the bond market can’t be fooled—and by the looks of it, isn’t.

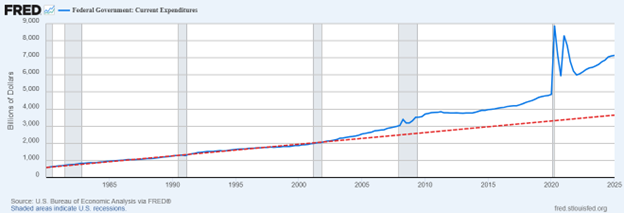

The U.S. government’s fiscal house is certainly not in order; far from it. Federal spending is much, much too high, so high that no plausible amount of economic growth can undue the damage of the decision of President Joe Biden (or whoever was wielding his autopen) and the Democrat-controlled Congress of 2021 and 2022 to increase federal spending rapidly after the Covid lockdowns instead of returning expenditures to the 2019 trend line:

The federal government is now spending about $1.4 trillion more per year than it would be if the Congress and president had reduced spending back to the pre-Covid trend line, which was already excessive. Now it seems that no one has any stomach for a return to the previous decade’s level of fiscal insanity, much less to the 1980-2001 trendline that fiscal conservatives rightly considered imprudent at the time:

Unlike Congress, President Trump has been doing whatever he can to reduce the size of the federal government and the damage it does. The first-quarter 2025 GDP report demonstrates that, Antoni notes:

[T]he best part of the GDP report was this showstopper: investment (the impetus of long-run real economic growth) is skyrocketing, up 21.9 percent at a seasonally adjusted annualized rate.

Under Biden, investment lagged badly below its pre-pandemic trend, even turning negative by the end of his term.

Trump has managed to reverse that in short order, partly by promising the world that he will transform America into the most business-friendly country on the planet via tax and regulatory cuts and boosts in energy production. Those promises incentivize reshoring of manufacturing and the industrial base.

The only way to attack the federal debt and the damage it is doing is to cut spending. Any truly meaningful cuts, however, will require action by Congress. Although I support the Big Beautiful Bill as absolutely necessary, I see it as only the first step. The nation’s economy needs a serious cut in federal spending. Nothing else will do. Fringe Finance outlines what will happen without those cuts:

And no matter what side of the argument you’re on for Trump’s big, beautiful bill, there’s no doubt that the bond market is going to settle this dispute. If the bill passes and bond yields continue to rise, it will continue to tighten the fiscal screws for the United States.

The bond market blowing up has no silver lining either. As yields rise, so will the amount of interest we pay on the national debt, and it’ll publicly broadcast a lack of confidence in U.S. paper. And if the likely scenario occurs where the Fed somehow steps in with printed money and utilizes big banks to steady the Treasury market (sometimes called yield curve control, or a version of it)—that could thrust the United States further down the stagflationary path it’s already on.

Look at those two charts above. Politicians, academics, and journalists can complain all they want about how tax cuts and spending cuts will help the wealthy the most and make things tougher for low-income people dependent on taxpayer handouts, but the rise above those trendlines shows waste and excess, not better treatment of the needy. The higher spending is a result of increasing government programs to include millions more higher-income people, as with the Medicaid expansion, which has tilted the program from helping the truly needy into a replacement for private insurance.

The nation cannot sustain that kind of spending. It will end, either by choice or by necessity as the result of an economic crash. As Fringe Finance notes, the bond markets are telling us that the most careful investors are losing trust in the U.S. government’s ability to pay its bills. We should listen to them. The government must act now to cut spending back at least down to the 2019 trendline.

I cannot see that happening. Half the Congress is willing to destroy the national economy in hopes the disaster will prompt voters to return them to power. The other half is terrified of being held responsible for doing the right thing and making more people who can earn their keep do so. This bill is beautiful, as far as it goes. Unfortunately, it tackles only half the problem—the easy part. That is how governments fall and nations decay.

Great post Sam. An insightful and incisive read. A new online journal awaits you!

Scary stuff! I especially fear for my kids, inheriting this mess.