Biden Handed Trump a Poison Chalice

The necessary fiscal and regulatory reforms will require a level of courage that Republicans other than Trump himself have seldom shown.

The economy that Joe Biden and the progressive political, business, and cultural oligarchs are handing over to Donald Trump today is a poison chalice. After four years of Biden’s weapons of mass economic destruction, the foundations of the U.S. economy are crumbling.

Inflation is on the rise again (Reuters):

In the 12 months through December, the CPI advanced 2.9%. That was the largest rise since July and followed a 2.7% increase in November. Some of the rise in the annual CPI rate reflected last year's low readings dropping out of the calculation. Economists polled by Reuters had forecast the CPI gaining 0.3% and rising 2.9% year-on-year.

Consumer prices increased 2.9% in 2024, slowing from 4.1% in 2023. Progress bringing inflation back to its target recently hit a snag. Consumers' inflation expectations soared in January, with households concerned that tariffs would raise goods prices.

Enormous federal budget deficits caused entirely by overspending brought on the inflation, and they will continue unless we get unprecedented spending cuts (Mises Wire):

The United States’ insane inflation is solely due to out-of-control spending and currency printing. Corporations, wars, or supply chains cannot cause aggregate prices to rise, nor can they consolidate the increase even at a slower pace. Although this can have an impact on individual prices, the only factor that causes aggregate prices to rise year after year is the decline in the value of the US dollar that the government issues.

Over 20.5% accumulated inflation over the past four years, government deficit spending has reached nearly $2 trillion annually despite record tax receipts and a growing economy, public debt has reached almost $36 trillion, and the monthly job figure includes an astonishing 43,000 new government jobs each month.

Rising government debt is fueling an upward spending-debt-inflation spiral (The Tax Foundation):

The chronic deficits are partly due to rising interest on the debt, which is set to exceed defense spending this year for the first time ever and grow to a record high of 3.2 percent of GDP next year before rising higher to 3.9 percent in 2034. Debt held by the public is projected to rise steadily from 99 percent of GDP this year to 106.3 percent in 2028, exceeding the high set at the end of World War II, and then escalate to 116 percent in 2034 and 166 percent in 2054.

The money supply is growing again after contracting in the past two years (Mises Wire):

Money-supply growth rose year over year in November for the fourth month in a row, the first time this has happened since the four months ending in October of 2022. The current trend in money-supply growth suggests a significant and continued turnaround from more than a year of historically large contractions in the money supply that occurred throughout much of 2023 and 2024. As of November, the money supply appears to be entering a new and accelerating growth period.

In November, year-over-year growth in the money supply was at 2.35 percent. That’s a 27-month high and the largest year-over-year increase since September 2022. November’s growth rate was up from October’s growth rate of 1.45 percent. It’s a large reversal from November 2023’s year-over-year decline of 8.5 percent.

A resumption of money-supply growth after a decrease often precedes recessions (also Mises Wire):

Money supply growth can often be a helpful measure of economic activity and an indicator of coming recessions. During periods of economic boom, money supply tends to grow quickly as commercial banks make more loans. On the other hand, two or three years before a recession begins, we tend to see periods during which money supply growth slows or turns negative. It should be noted that the money supply does not need to actually contract to signal a recession. As shown by Ludwig von Mises, recessions are often preceded by a mere slowing in money supply growth.

All that said, recessions tend not to become apparent until after the money supply has begun to accelerate again after a period of slowing. This was the case in the early 1990’s recession, the Dot-com Bust of 2001, and the Great Recession. This may be the trend we are seeing now.

The previous and current growth in the money supply suggest that the Fed is adding inflation to the likely upcoming stagnation—a classic stagflation scenario (also Mises Wire):

Money supply changes and CPI rarely follow a linear or one-to-one relationship, but with the Fed returning to a policy of easy money, after adding trillions of dollars to the money supply in just a few years, we can expect this to fuel further increases to both asset price inflation and consumer price inflation in coming years.

America’s businesses are hobbled by excessive taxes (The Daily Signal):

In August 2022, President Joe Biden signed the misnamed Inflation Reduction Act into law, which included a new tax on companies’ financial statement income, new IRS funding to increase audits, an excise tax on stock buybacks, and more taxes on natural gas, oil, and coal. To top it off, certain Trump administration business tax cuts simultaneously have been phasing out.

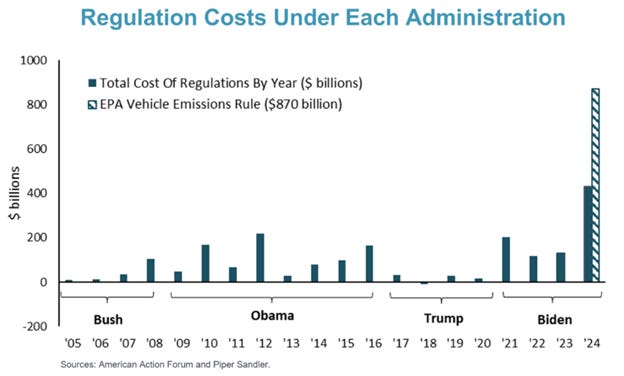

… and regulation (Unleash Prosperity):

On the subject of leaving behind a mess, no president has ever regulated like Joe Biden. In 2024 alone, his new regulations have cost the economy an estimated $1.4 trillion. His auto emission rules—which are nearly impossible for the auto industry to meet—were the most costly.

Biden’s tax rate hikes backfired, increasing the federal deficit by a half-trillion dollars or more on their own, spurring inflation (The Daily Signal):

On paper, [the tax increases in the Inflation Reduction Act added] up to more than $60 billion in tax hikes in 2023.

Yet, as of July 31, tax revenues are down almost $400 billion from the same time last year, representing a 13% drop in tax receipts—even larger after accounting for inflation.

It’s unusual for tax revenues to drop from one year to the next, as it’s happened only eight times since 1960. And only once in that 63-year period—from 2008 to 2009—did revenues fall by more than 7%.

The U.S. stock markets are massively overvalued, because there is no other halfway decent place to invest (Classical Principles):

The S&P500 closed Wednesday 43% above our estimate of value. Stocks are priced for good news and are vulnerable to disappointing news. They are even more vulnerable since technical indicators have weakened considerably and the breadth of the weakness has spread to more sectors.

Job creation for native-born American workers is nonexistent (Mises Wire):

In 2023, nearly 25% of all job gains were government ones, and the entirety of the growth of the labor force in the past four years came from foreign workers.

American households are weighed down by debt, seen most vividly in the record level of credit-card debt (Fast Company):

This holiday season has come with a hefty price tag: record-high credit card debt.

Over a third of (36%) of American consumers took on holiday debt, according to a new survey from LendingTree, with average balances of $1,181, up from $1,028 in 2023. The good news? That is still down from $1,549 in 2022.

Heading into the peak shopping season, credit card balances rose by $24 billion in the third quarter of 2024 and are 8.1% higher than a year ago, according to the Federal Reserve Bank of New York’s report on household debt. Collectively, Americans currently owe a record $1.17 trillion on their credit cards.

Housing is becoming increasingly unaffordable as interest rates rise (The Wall Street Journal):

Mortgage rates rose above 7% for the first time since mid-2024, an early setback for a housing market that is coming off two consecutive years of poor sales.

The average rate on the standard 30-year fixed mortgage rose to 7.04% this week, according to a survey of lenders by mortgage-finance giant Freddie Mac. …

The housing market has slumped in recent years as high mortgage rates and expensive home prices made home-buying unaffordable for many Americans. It hasn’t helped that other costs of homeownership, such as insurance and taxes, have also surged. Sales of previously owned homes in 2024 likely fell to the lowest level since 1995, for the second year in a row.

I have consistently argued that the only way out of this mess is to cut taxes, spending, and regulation by a lot. That remains true, and President Donald Trump has repeatedly indicated that his economic plan relies on those principles, although tariff increases would work against that (though only mildly and temporarily). Trump’s plans for renewal of the 2017 tax cuts and for further significant cuts in income and business tax rates and in government spending and regulation are exactly what the economy and the American people need.

Whether Trump and the congressional Republicans will have the courage to go through with this plan is an open question, especially with the media inevitably characterizing these policies as draconian, cruel, inflationary, and probably fattening and carcinogenic. History does not provide much cause for optimism in that regard.

In any case, it may well be too late for the proposed cuts to tax rates, spending, and regulation to avert a recession or even stagflation. However, those policies would certainly make for the fastest possible path to economic recovery, as President Warren G. Harding demonstrated. That is the best we can probably hope for.