A Good GDP Decrease

If the nation's measured economic output decreases for the right reasons, that is good news. That's what happened in the past quarter

The stock markets rose last week despite an overall contraction in the nation’s gross domestic product (GDP).

Or was that because of the reduction of GDP?

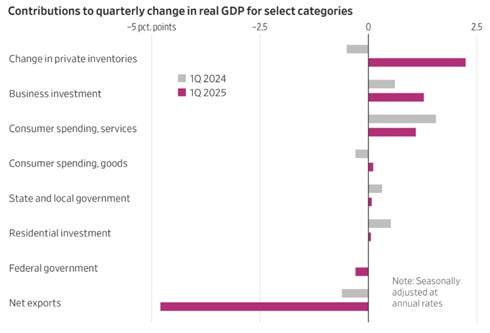

Private-sector production rose during the quarter, and at a rate that surprised most analysts. The negative movements were in federal spending and net exports:

Source: The Wall Street Journal

Net exports had nearly 5 percentage points of negative effect on the GDP number, as the chart indicates. Exports by U.S. businesses rose modestly after a weak fourth quarter of 2024, and imports rose dramatically as businesses stocked up on other countries’ goods in anticipation of higher prices to come. That is exactly what happened when Trump imposed tariffs in 2018. Import prices then fell until the onset of the pandemic in 2020. The decrease in import prices was good for the economy.

The first-quarter 2025 purchases of imported items increased business inventories, with the difference between the two amounting to about 2.5 percent of GDP. Federal spending decreased by 5.1 percent annualized, and state and local spending rose by 0.8 percent annualized.

Real GDP contracted at an annualized rate of 0.3 percent. Given the increase in imports, which is a one-off, the economic numbers are fairly sound, with the reduction of federal spending a big, positive factor that will have constructive long-term effects. The spending reductions are unlikely to continue at this pace, though any spending cuts are beneficial in economic terms.

Employers added 177,000 jobs in April, much more than expected and 25,000 above the average monthly gain for the past 12 months, the Bureau of Labor Statistics reported. Even better, these jobs were in the productive private sector, as federal government employment declined by 9,000. The unemployment rate remained unchanged, at 4.2 percent.

Stock markets rose after the employment report hit, consolidating recent gains. The Wall Street Journal reports:

Stocks extended their multiday climb Friday, following better-than-expected jobs numbers and signs of a potential thaw between Washington and Beijing.

The Dow industrials, the S&P 500 and the Nasdaq Composite rose 1.3% or more. The S&P, which rose 1.5%, closed higher for a ninth straight session, its longest streak of daily gains since 2004.

Note that The Wall Street Journal story attributed the stock market rise to “better-than-expected jobs numbers and signs of a potential thaw between Washington and Beijing.” The paper’s Friday market report even took credit for the market rise: “Major indexes got a midday boost after The Wall Street Journal reported that Beijing is considering ways to address the Trump administration’s gripes over China’s role in the fentanyl trade.”

It is important to note that the markets were rising on Thursday and trending upward before that, well before the tariff story broke. While nearly everybody is waiting for President Trump to drop the rest of his proposed tariffs before they will breathe easier, I remain most concerned about the delays in Congress passing the “big, beautiful bill” extending the 2017 tax cuts and establishing additional much-needed reductions of taxes and spending.

Failure to extend the 2017 cuts would impose an enormous tax increase on American individuals, businesses, and investors, and they would not increase federal tax revenues but in fact decrease them, as I note in my recent Heartland Institute paper, “Federal Budget Deficits and the Iron Law of Federal Revenue.”

The economic fundamentals are all-important, and taxes, government spending, and regulation are the biggest direct influences on that, with the highly consequential monetary actions of the Federal Reserve being done in reaction to those basics (and usually too late, too severely, and for too long).

That is why I think the biggest driver of the recent business uncertainty is the taxing, spending, and regulation movements by the federal government. Trump has made strong progress in reducing regulation and is sure to do more in that regard. That will cut business costs and spur investment. Trump’s regulatory reforms targeted at reducing energy costs will add substantially to that effect.

Those regulatory reforms will spur greater investment in U.S. businesses and an overall expansion on the supply side of the economy. The wages and profit dividends from that expansion will show up as positive numbers on the demand side. That is certainly buoying the private sector economy and bodes well for the future.

The positive motion is occurring despite the current high interest rates and the Fed’s asset sales, both of which tighten the money supply—aka quantitative tightening. The Fed has slowed its asset sales but has not stopped them:

Source: American Action Forum

Interest rates remain much higher than during the pre-Trump near-zero-interest rate regime and the two pandemic years:

Trump was understandably critical of the Fed’s interest rate increases during his first term, but the previous near-zero interest rates were creating huge distortions in the nation’s economy during the Obama years, and they needed correction. Easy money causes misallocation of assets, by increasing investment in risky and underperforming ventures, and extremely easy money leads to extreme misallocations of assets.

As we saw with the huge investments in tech companies that never showed any profits, some of which had little or no revenue at all, easy money undermines sound investment and the proper allocation of resources.

One of the things we are seeing now is the reversal of that process, which is a very positive development. It represents a move toward greater economic efficiency and attention to what people really want, instead of where speculators think that they can make the quickest buck (though the latter is always around).

What the country needs most urgently is one more thing: the biggest, most beautiful tax cuts Congress can bear to pass.

As far as the U.S. economy is concerned, nothing else matters much in comparison with that.